5 Signs You Need a Financial Second Opinion

Life is busy which is why you hired a financial advisor to help manage your money. While you may feel like your finances are under control, the wrong advisor could be giving you false confidence. Bad financial advice can be expensive at best, or even dangerous to your financial security.

To ensure that you're benefiting from your advisor, check out these five warning signs. If you recognize any of them, you may need a financial second opinion.

The Value of a Good Advisor

Working with a good financial advisor can save you time, money, and stress. The 2023 FP Canada Financial Stress Index found that Canadians working with a Certified Financial Planner feel better about their finances:

In addition to feeling better, those working with an advisor make better decisions. Research from Morningstar has shown that households with a financial planner are more likely to have good savings habits and an appropriate level of risk in their investment portfolio.

While there are benefits of working with an advisor, you may not be getting the full benefit if you recognize any of these signs:

1. You Don't Have a Financial Plan

Many Canadians don't have a financial plan, despite working with an advisor. Instead, they're likely to have only an illustration of how their investments will grow over time.

A recent survey found that 30 percent of Canadians don't have a financial plan. I would bet that the real number is significantly higher. Clients will occasionally bring in plans created by other advisors for me to review. The quality of these plans has varied widely, and only about half could be called real financial plans.

One reason for this lack of true planning is that the average advisor simply has too many clients. According to Investment Executive, the average advisor had 221 clients in 2023:

There is simply no time to make financial plans for all of them.

The median time to create a comprehensive financial plan is about 10 hours. The average advisor would have to work overtime just to create plans for all their clients. Bank advisors are under even more time pressure with an average of 275 clients.

So what should your financial plan look like? At a minimum, it should include:

an overview of your current situation (not just your investments)

a statement of your financial goals

a timeline for when you're likely to achieve them

steps to make it all happen.

It should also be something that you understand and the steps need to feel achievable.

2. Your Advisor is a Friend or Family Member

Many financial advisor positions are sales jobs in disguise. The marketing strategy of a few major firms is to have new advisors sell to their friends and family.

When I first considered becoming a financial planner, I met with a manager at a big local firm. I was told to make a list of 50 friends and family. I would then be tasked with calling them to see who would let me manage their investments.

I wanted to learn about financial planning and how to help people make better financial choices, but I was instead pushed into a sales position. I quickly decided that it wasn't the right option for me. It wasn't until several years later that I decided to join the industry as an advice-only financial planner.

A recent client had an investment advisor who was an old friend from university. When I reviewed the investments I found that his average mutual fund fee was over 2.5%. This is quite a bit higher than average.

While my client liked supporting his friend's business, he wasn't happy to find out he was paying a premium to do so. This expensive advice was costing him an extra few thousand dollars per year.

While your friend or family member is well-intentioned, the training at these big firms often focuses on selling expensive investment and insurance products.

The cost of these products can be a huge drag on your financial success.

3. You're Feeling Sales Pressure

This one is simple: Feeling pressured to buy an investment or insurance product is a red flag.

Unfortunately, the pay structure at Canadian banks pushes customers into high-fee products.

The large commissions earned from insurance sales also influence the amount and types of insurance recommended to clients.

When working with an advisor, you need to understand how they get paid. This will allow you to assess their advice and know if you should get a second opinion.

4. Your Advisor Tries to "Beat the Market"

The vast majority of mutual funds that try to beat the market FAIL to do so over the long term.

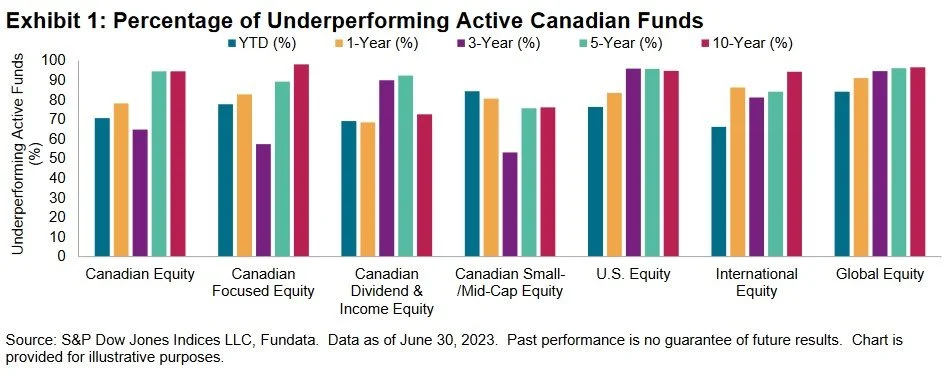

Despite this poor track record, many advisors still try to convince clients that this is the right way to invest. Let’s look at some data from the SPIVA Canada Scorecard:

The results are not pretty for portfolio managers who try to beat the market.

The percent of mutual funds that UNDER perform over 10 years:

Canadian Equity - 94.57%

US Equity - 94.83%

International Equity - 94.29%

You shouldn't be paying an expensive portfolio manager for what will likely be poor returns. Instead, keep it simple and buy the whole stock market at a reasonable fee.

If your advisor won't help you do this, take it as a sign to start looking elsewhere.

5. Life is Getting More Complex

Even if you have a good advisor, there may be times when you need more specialized advice than what they can offer.

There are approximately 100,000 financial advisors in Canada. Yet many of them would more appropriately be called investment advisors. Since their compensation is tied to the investments they oversee, that is where they focus most of their time.

This can be a problem since there is more to personal finances than just investing. Topics such as tax, pensions, and government benefits play a critical role in retirement planning.

For example, the wrong advice for when to take CPP can easily cost over $100,000.

Of the advisors in Canada, only about 17,000 have taken the training to earn the Certified Financial Planner designation. If you're feeling nervous about retirement, having a CFP professional give you the "all-clear" can give you the peace of mind you need.

Where to Go for a Second Opinion

If you recognize any of the above signs, you may want to get a financial second opinion. An advice-only financial planner is a natural fit for this service.

In contrast to traditional advisors whose pay is tied to investments managed or insurance sold, advice-only financial planners are paid directly by their clients. This removes the potential for biased advice.

An advice-only advisor also has no incentive to try and get you to move your investments. If nothing is wrong with your investments, why go through the hassle of moving them?

And if your investment fees are higher than average, an advice-only planner can be in your corner to help negotiate for lower-cost investments.

If you have any doubts about your current advisor, getting a second opinion is often money well spent.

To see if this could benefit you, I offer a free introductory meeting.